I. Introduction

In the ever-changing landscape of modern business, it is crucial for business owners and investors to understand the various strategies used to protect a company’s interest from hostile takeovers. One such strategy is the implementation of “poison pills.” This article aims to provide a comprehensive guide to understanding poison pills, their advantages and disadvantages, and ethical considerations.

II. Understanding Poison Pills: A Guide for Business Owners

A. Definition and Origins of the Term “Poison Pill”

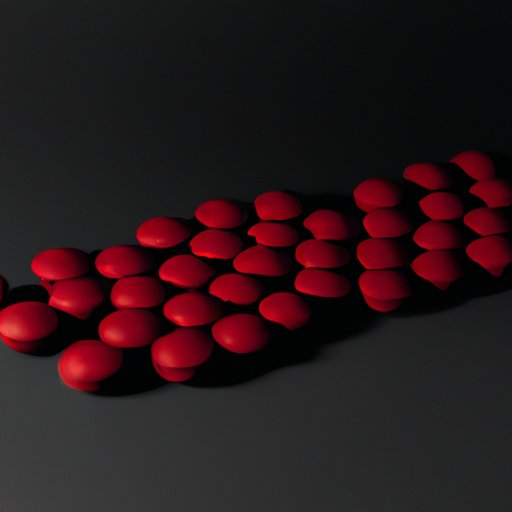

A poison pill is a business strategy designed to discourage hostile takeovers and protect a company’s shareholders. The term “poison pill” originated in the 1980s and draws inspiration from the concept of poisoning a hostile party attempting to take over a company.

B. How Poison Pills Work

Poison pills are a defensive maneuver used by companies to deter or discourage a hostile takeover attempt. They work by making the acquisition of the company less attractive financially. The most common form of poison pill is the shareholder rights plan, which allows existing shareholders of the company to purchase additional shares at a significant discount in the event of a hostile takeover. This dilutes the value of the acquiring company’s shares and makes the takeover much more expensive.

C. Reasons for Adopting a Poison Pill Strategy

The primary reason for adopting a poison pill strategy is to protect the interests of the company and its shareholders. Hostile takeovers can be detrimental to a company’s operations and lead to significant financial losses. Poison pills force the acquiring company to negotiate with the target company’s board of directors and increase the price and terms of the acquisition, leading to a better outcome for the company and its shareholders.

III. The Pros and Cons of Poison Pills in Business

A. Advantages of Poison Pills

Poison pills are designed to deter hostile takeovers, which can be disruptive to a company’s operations and lead to significant financial losses. They allow existing shareholders to retain control and protect the company’s interests. Poison pills also offer negotiating leverage, as the acquiring company would need to offer a higher price and more favorable terms to convince the existing shareholders to sell their shares.

B. Disadvantages of Poison Pills

The main disadvantage of poison pills is that they can be seen as an anti-shareholder strategy. They can block shareholder votes on acquisitions, giving the board of directors more control. Poison pills can also be expensive to implement and maintain, leading to additional expenses for the company.

C. The Importance of Weighing the Pros and Cons Based on Specific Circumstances

It is essential to weigh the pros and cons of implementing a poison pill strategy based on specific circumstances. The board of directors must consider the potential costs, impact on shareholders, and the strategic goals of the company before implementing a poison pill strategy.

IV. How Poison Pills Protect Companies from Hostile Takeovers

A. The Rise of Hostile Takeovers in Recent Years

In recent years, there has been an increase in hostile takeovers in the corporate world. Hostile takeovers occur when a company attempts to acquire another company without the approval of the target company’s board of directors. The acquiring company often offers a premium to the target company’s shareholders to entice them to sell their shares.

B. How Poison Pill Strategies are Used to Rebuff Hostile Takeover Attempts

Poison pill strategies are often used to rebuff hostile takeover attempts. They enable the target company’s board of directors to take control of the acquisition process, negotiating with the acquiring company to increase the price and improve the terms of the acquisition. Poison pills can also trigger if the acquiring company purchases a certain percentage of the target company’s stock, making the takeover much more expensive.

C. Case Studies of Companies That Have Successfully Defended Their Interests

Several companies have successfully defended their interests using poison pill strategies. For example, in 2010, Airgas, Inc. used a poison pill strategy to prevent hostile takeover attempts by Air Products & Chemicals Inc. Air Products & Chemicals Inc. made several acquisition offers, but each was rebuffed by the implementation of a poison pill strategy. Airgas eventually agreed to be acquired by Air Products & Chemicals Inc., but at a much higher price than originally offered.

V. Common Types of Poison Pills and How They Work

A. Overview of the Most Common Types of Poison Pills

The most common type of poison pill is the shareholder rights plan, which gives existing shareholders the right to purchase additional discounted shares if a hostile takeover attempt occurs. Other types of poison pills include the “golden parachute” plan, which provides executives with significant severance pay and stock options in the event of a hostile takeover, and the “crown jewel” plan, which involves selling off key assets or business lines to make the target company less attractive to acquiring companies.

B. Analysis of the Strengths and Weaknesses of Different Poison Pill Strategies

Each type of poison pill strategy has its own strengths and weaknesses. The shareholder rights plan is the most common and allows existing shareholders to maintain control, but it can also dilute the value of existing shares. The golden parachute plan can discourage acquisitions, but it can also lead to excessive compensation for executives. The crown jewel plan can protect key assets, but it can also lead to reduced value for the company.

C. Examples of Well-Known Companies That Have Implemented Poison Pill Strategies

Many well-known companies have implemented poison pill strategies, including Monsanto, Hershey, and Yahoo. In 2017, Whole Foods implemented a poison pill strategy to protect the company from a hostile takeover attempt by Jana Partners. Jana Partners eventually backed down from its attempt to acquire Whole Foods.

VI. The Ethics of Poison Pills in Business: A Debate

A. The Two Sides to the Poison Pill Debate

There is a debate among business experts and analysts regarding the ethical considerations of implementing poison pill strategies. Some argue that poison pills protect a company’s interests and are a legitimate business strategy. Others argue that poison pills are anti-shareholder and give too much control to the board of directors.

B. The Argument in Favor of Poison Pills

Proponents of poison pills argue that they protect a company’s interests and ensure that a hostile takeover does not occur without negotiation. Poison pills can also help prevent a company from being acquired at an undervalued price.

C. The Argument Against Poison Pills

Opponents of poison pills argue that they can be used to block shareholder votes and give too much power to the board of directors. They can also lead to excessive compensation for executives if a golden parachute plan is implemented.

VII. What Investors Need to Know About Poison Pills

A. How Poison Pills Affect a Company’s Stock Price

Poison pill strategies can affect a company’s stock price, as they can dilute the value of existing shares. However, the implementation of a poison pill strategy can also lead to increased negotiating leverage, potentially leading to higher stock prices.

B. The Potential Implications for Investors

For investors, the implementation of a poison pill strategy can be both positive and negative. While it can protect a company’s interests and potentially lead to higher stock prices, it can also be a sign of a hostile takeover attempt or poor management decisions. Investors should closely analyze a company’s decision to implement a poison pill strategy and assess its potential impact on the company’s financial health.

C. Strategies for Investing in Companies That Use Poison Pills

Investors should consider several factors when investing in companies that use poison pills. They should evaluate the company’s management team, the potential for a hostile takeover, and the reasons for implementing a poison pill strategy. Investors should also closely monitor any changes in the company’s financial health or strategic goals, as these can affect the value of their investments.

VIII. Conclusion

In conclusion, poison pill strategies are a defensive maneuver used by companies to protect their interests and deter hostile takeovers. While they have advantages and disadvantages, their implementation should be based on specific circumstances and strategic goals. For business owners and investors, understanding poison pills is essential, as they can have a significant impact on a company’s financial health and shareholders’ interests.